Are you searching for 'marriott case study harvard business'? You will find the answers here.

Table of contents

- Marriott case study harvard business in 2021

- Marriott corporation case study

- Marriott corporation project chariot case solution

- Project chariot marriott

- Marriott corporation the cost of capital solution xls

- Marriott corporation: the cost of capital case solution

- Marriott corporation: the cost of capital chegg

- Marriott corporation case study pdf

Marriott case study harvard business in 2021

This image demonstrates marriott case study harvard business.

This image demonstrates marriott case study harvard business.

Marriott corporation case study

This image demonstrates Marriott corporation case study.

This image demonstrates Marriott corporation case study.

Marriott corporation project chariot case solution

This image demonstrates Marriott corporation project chariot case solution.

This image demonstrates Marriott corporation project chariot case solution.

Project chariot marriott

This picture shows Project chariot marriott.

This picture shows Project chariot marriott.

Marriott corporation the cost of capital solution xls

This image representes Marriott corporation the cost of capital solution xls.

This image representes Marriott corporation the cost of capital solution xls.

Marriott corporation: the cost of capital case solution

This image illustrates Marriott corporation: the cost of capital case solution.

This image illustrates Marriott corporation: the cost of capital case solution.

Marriott corporation: the cost of capital chegg

This picture demonstrates Marriott corporation: the cost of capital chegg.

This picture demonstrates Marriott corporation: the cost of capital chegg.

Marriott corporation case study pdf

This image illustrates Marriott corporation case study pdf.

This image illustrates Marriott corporation case study pdf.

What are the three main lines of business for Marriott?

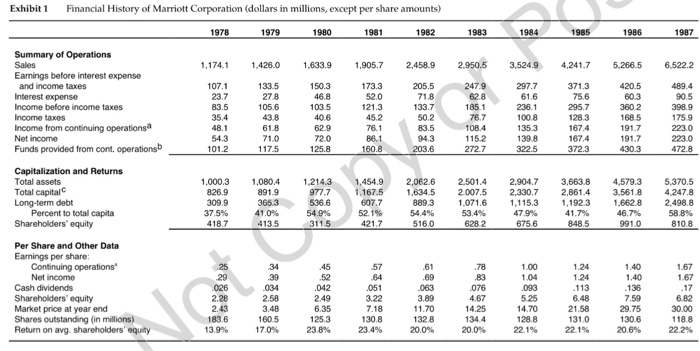

According to Harvard Business School, Marriott had three main lines of business: lodging, contract services and restaurants. Each line of business is calculated as an independent company due to the different risk and business operations across the three divisions.

What kind of cost of capital does Marriott use?

Marriott uses the Weighted Average Cost of Capital (WACC) as a metric for cost of capital.

Why are Marriott approving more high risk projects?

Over time, Marriott will be approving more high risk project from the restaurant and contract service division by evaluating them at a lower rate, while they will be rejecting lower risk projects from the lodging division because they are using a higher rate.

What was the third strategy of Marriott Corporation?

The third strategy was optimizing the use of debt in capital structure. Marriott used an interest coverage target instead of a target debt-to-equity ratio, 59% of total capital. The final strategy was repurchasing undervalued shares. Marriott was focused on repurchasing stocks that fell under their “warranted equity value.”

Last Update: Oct 2021